Let’s cut to the chase. Brokers want more traders that actually trade. Acquiring a new client can cost 5x as much as retaining existing ones. And retaining a trader can enhance profitability by 25% to a massive 95%. But retaining inactive traders doesn’t generate profits for brokers. As the leading content marketing agency for the finance space, we’re often asked for actionable content. One of the most important resources for traders is timely and accurate market analysis that accelerates decision-making. Here’s how to deliver analysis that drives trading activity.

Here are three types of analyses you can provide to get your traders to identify viable trading opportunities.

#1 Fundamental Analysis

It’s no secret that fundamental analysis is the foundation of trading equities. But it is equally essential to understand the fundamental behaviours of instruments such as commodities and currencies (both fiat and crypto) to decipher their reaction to market, geopolitical and economic developments. For instance, the euro took a hit after natural gas prices shot up following the sanctions against Russia in August 2022. So much so, that the euro fell below parity with the dollar for the first time since December 1999.

An informed trader might have anticipated the capacity of the US to expedite oil production even as global inflationary fears were setting the stage for the euro’s fate. You can be the broker that provides the right information at the right time.

Make it Actionable

- Email unique analysis. Traders love to get the latest news and fundamental analysis direct to their inbox. Get them prepped for the day ahead with our unique analysis tailored for the currencies, cryptos or commodities you want them to trade!

- Educate newbies. Analysis can be hard to grasp for new traders and we get that. Segregate your education centre so that you can properly explain the technicals to new traders without weighing down your pro traders.

- Make your images pop. People process visuals 600 times faster than a line of text. Add charts and images to support your content, keep the design clean and use identifiable separators to classify content. Subtle customisations, such as a time-zone-based night mode display add a personal touch. If you’re more on the Gen Z end of trading then go with humorous gifs and memes that traders will find relatable.

Check out parody account Not Jerome Powell on Twitter.

#2 Technical Analysis

With the financial markets moving 24/7, price chart patterns, analysis and predictions become key to seizing opportunities without losing time. In the global markets, every second counts, especially for scalpers and high-frequency traders. Updates and accurate technical analyses help traders identify entry and exit levels.

A recent example is Uber’s earnings report for the final quarter of 2022, announced in February 2023. Analysts had expected Uber to have garnered revenues of $8.51 billion, which could lend support to the stock and push its price up. The earnings numbers, however, beat these optimistic predictions, and Uber’s stock closed 3% higher following the report’s release. The market belief that Uber must have grabbed a portion of rival Lyft’s market share resulted in Lyft’s stock tumbling about 36% the next day.

Technical analysis helps identify these overbought or oversold situations. It also helps traders predict reversals or breakouts to adjust their trading strategies accordingly. Sentiment plays a significant role too in driving asset prices much deeper than a trader might otherwise anticipate.

Make it Actionable

- Deliver tailored reports – Contentworks Agency delivers tailored technical analysis to the world’s top brokers and exchanges. These give actionable trading cues on trending stocks or currency pairs. Get a deep dive or a bitesize report depending on your audience demographic. Our team of experts are adept at creating market briefs for your website, shorter and impactful email versions and accompanying social media posts. We also ensure that your emails are developed in HTML, so that you can instantly upload them to your email server.

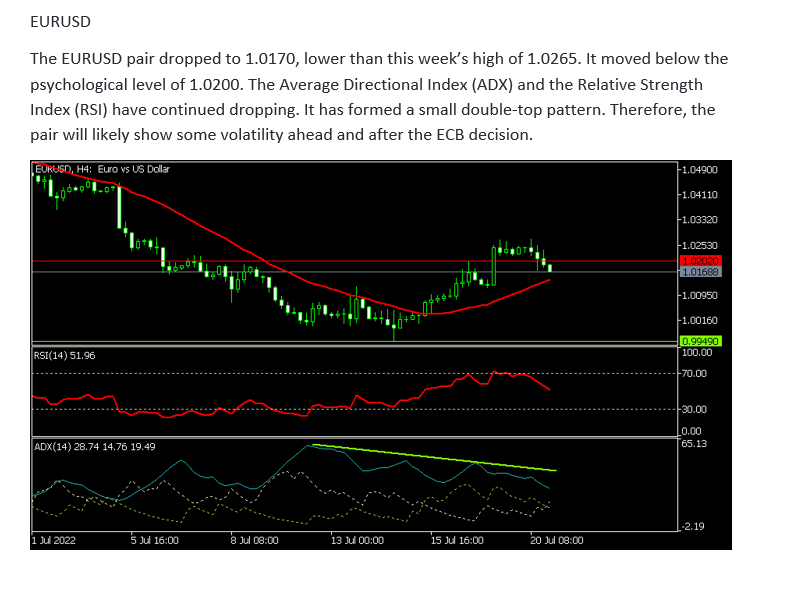

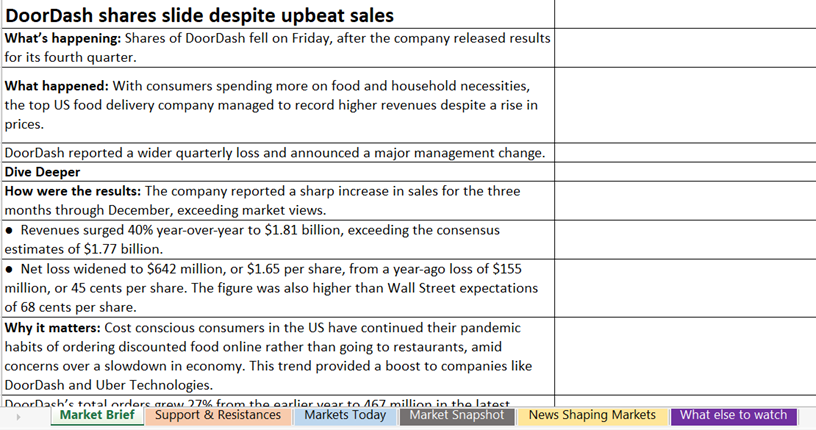

Check out this extract from a Contentworks Agency technical analysis report. We can deliver forecasts and reviews every day. View more over in our portfolio.

- Get trending tweets – Tweeting trending finance updates pushes traders towards those deposit/trade now buttons. We deliver evergreen or trending tweets that utilise the top finance hashtags to snare pro traders.

- Make it fun with a video – Videos are great at explaining difficult concepts or showcasing fast market news. We produce daily and weekly animated videos for our brokers that include key market takeaways, events coming up and what to watch out for. You can share your videos on social media, email or via email and your traders will grab all the key info in under a minute.

A sample of one of our indepth and client tailored, market briefs.

#3 News and Sentiment Analysis

Markets are impacted by news events from across the globe. But some might have a greater impact than others. For instance, the US NFP report, released on the first Friday of every month, gives insights into the world’s largest economy. The numbers tend to move the US dollar, which then affects the global markets. A similar report from another country may only have a localised, short-lived impact since the domestic currency is unlikely to have an impact as large as the greenback on most assets.

Geopolitical news, natural disasters and central bank monetary policy decisions, such as interest rate changes also move the markets. Such news affects asset prices because they impact the sentiment of market participants. For instance, interest rate hikes by the US Fed through 2022 kept concerns regarding an impending recession high. Similarly, news of the Ukraine invasion and ensuing sanctions led to fears regarding uncontrollable inflation in Europe.

Make it Actionable

- Align your campaigns with upcoming events – Planning is key in the finance space. So by understanding the finance events that lie ahead, we can match them to your campaigns, social media activity, blogs and live videos. Want an interview with your head dealer that goes live on NFP day? Or some live tweeting from your finance event? We’ve got you covered.

- Make it Tailored – One size never fits all when it comes to marketing financial assets. There are different assets, demographics, conditions, USPs and regions. If your audience is Gen Z then tailor the content for them and the issues that matter to them. Identify the channels your traders prefer and provide segregated, personalised insights on these platforms. Or leave it to us.

- Create FOMO – Fear of missing out is a powerful tool when it comes to driving trading activity. Create FOMO by sharing news about winning trades, success stories, the number of people on your platform right now, event countdowns and exclusive deals. Learn how to create FOMO over at our content bar.

Get a market minute video tailored to your brand – here’s one we made earlier!

The Clock Is Ticking – It’s Time To Get Actionable

We’re heading into Q2 and historically that’s a good time for trading activity. Grab your piece of the pie by delivering regular, accurate, unique analysis to drive actions from your traders.

In 2022, 70% of B2B marketers increased their content marketing budget, but only 50% of businesses intended to grow in-house content teams. Contentworks is a leader in helping brokers, fintechs, banks and hedge funds provide on-time and on-budget market analysis to their clients. Whether it’s daily reports, social media updates, blogs, emails, PRs or videos, we can work with you to make it happen.

Contact us to get your traders depositing and trading.